ETS: Energy Trading System

The European Union Energy Trading System (EU ETS) stands as a cornerstone of the EU’s efforts to combat climate change and transition towards a sustainable energy future. Established in 2005, the EU ETS represents the world’s first and largest cap-and-trade system for greenhouse gas emissions, covering around 45% of the EU’s total emissions. The system […]

The European Union Energy Trading System (EU ETS) stands as a cornerstone of the EU’s efforts to combat climate change and transition towards a sustainable energy future. Established in 2005, the EU ETS represents the world’s first and largest cap-and-trade system for greenhouse gas emissions, covering around 45% of the EU’s total emissions. The system operates across the 27 EU member states as well as Iceland, Liechtenstein, and Norway, fostering a unified approach to reducing carbon emissions across a diverse range of industries.

The European Union’s Emissions Trading System (EU ETS) is indeed a pivotal tool in the EU’s arsenal against global heating and greenhouse gas (GHG) emissions. Envisioned as a pioneering approach to addressing climate change, the EU ETS operates on the principle of cap-and-trade, aiming to curb emissions from some of the most significant polluting sectors while promoting cost-effective mitigation strategies.

At its core, the EU ETS sets a cap on the total amount of greenhouse gas emissions allowed within the covered sectors, which include energy-intensive industries like power generation, refining, and manufacturing. This cap decreases over time in alignment with the EU’s climate targets, ensuring a steady reduction in emissions. By placing a limit on emissions, the EU ETS effectively creates scarcity in the market for emission allowances, thereby incentivizing regulated entities to innovate and adopt cleaner technologies to stay within their allocated limits.

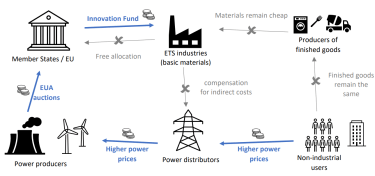

The system achieves its objectives through the issuance and trading of emission allowances, known as European Union Allowances (EUAs). These allowances serve as permits for companies to emit a certain amount of CO2 or other greenhouse gases. Initially distributed through a combination of free allocation and auctions, the allowances provide flexibility for companies to manage their emissions while ensuring overall emissions targets are met.

Crucially, the trading aspect of the EU ETS enables companies to buy and sell allowances based on their emissions needs and financial considerations. This creates a dynamic market where the price of allowances fluctuates based on supply and demand dynamics. Companies that can reduce their emissions below their allocated allowances can sell their surplus allowances for profit, while those facing difficulties in meeting their targets can purchase additional allowances to comply with regulations. This market-driven mechanism not only encourages emissions reductions but also fosters innovation and efficiency improvements as companies seek to optimize their operations and reduce costs.

At its core, the EU ETS employs a market-based mechanism to incentivize emissions reductions by putting a cap on the total amount of greenhouse gases that can be emitted by regulated industries. This cap decreases over time, aiming to achieve significant emissions reductions by 2030 and beyond. Participating industries, such as power generation, aviation, and heavy manufacturing, are required to hold permits, known as European Union Allowances (EUAs), for each ton of CO2 they emit. These allowances are either allocated for free or auctioned by member states, providing companies with flexibility in managing their emissions while ensuring overall emissions targets are met.

One of the key principles of the EU ETS is the concept of emissions trading, whereby companies can buy or sell allowances based on their individual emissions needs. This creates a market-driven incentive for companies to invest in emission-reducing technologies and practices, as those able to reduce their emissions below their allocated allowances can sell their surplus allowances for profit, while those exceeding their limits must purchase additional allowances to comply with regulations. This dynamic system encourages innovation and efficiency, driving the transition towards cleaner energy sources and processes.

Furthermore, the EU ETS incorporates various mechanisms to ensure its effectiveness and integrity. Robust monitoring, reporting, and verification procedures are in place to accurately track emissions and ensure compliance. Penalties are imposed on non-compliant entities, discouraging any attempts to circumvent the system. Additionally, periodic reviews and adjustments to the cap help align the EU ETS with evolving climate targets and scientific knowledge, ensuring its relevance and effectiveness in addressing climate change.

The EU ETS has demonstrated its effectiveness in driving emissions reductions, with studies indicating a notable decline in emissions from regulated sectors since its inception. Moreover, it serves as a model for other jurisdictions seeking to implement similar carbon pricing mechanisms to mitigate climate change and promote sustainable development.

In conclusion, the European Union Energy Trading System (EU ETS) represents a pioneering initiative in global climate policy, harnessing the power of market forces to drive emissions reductions and foster the transition towards a low-carbon economy. By incentivizing innovation, promoting efficiency, and ensuring compliance, the EU ETS stands as a testament to the EU’s commitment to combating climate change and securing a sustainable future for generations to come.

Reference:

-

European Commission. (2022). European Union Emission Trading System (EU ETS). Retrieved from https://ec.europa.eu/clima/policies/ets_en

-

European Commission. (2022). European Union Emission Trading System (EU ETS). Retrieved from https://ec.europa.eu/clima/policies/ets_en

-

European Commission. (2020). EU Emissions Trading System (EU ETS). Retrieved from https://ec.europa.eu/clima/policies/ets_en

-

European Environment Agency. (2021). Emissions trading in the EU. Retrieved from https://www.eea.europa.eu/policy-documents/emissions-trading-in-the-eu

-

World Bank. (2021). State and Trends of Carbon Pricing 2021. Retrieved from https://openknowledge.worldbank.org/handle/10986/35782

-

Ellerman, A. D., & Buchner, B. K. (2007). The European Union Emissions Trading Scheme: Origins, Allocation, and Early Results. Review of Environmental Economics and Policy, 1(1), 66–87. https://doi.org/10.1093/reep/rem003

-

Newell, R. G., & Pizer, W. A. (2003). Regulating stock externalities under uncertainty. Journal of Environmental Economics and Management, 45(2), 416-432. https://doi.org/10.1016/S0095-0696(02)00019-3

This article is a part of the class “751447 SEM IN CUR ECON PROB” supervised by

Asst. Prof. Napon Hongsakulvasu Faculty of Economics, Chiang Mai University

This article was written by Ditsanatda Chotloesak 631615021