Australians are the Richest People in the World?

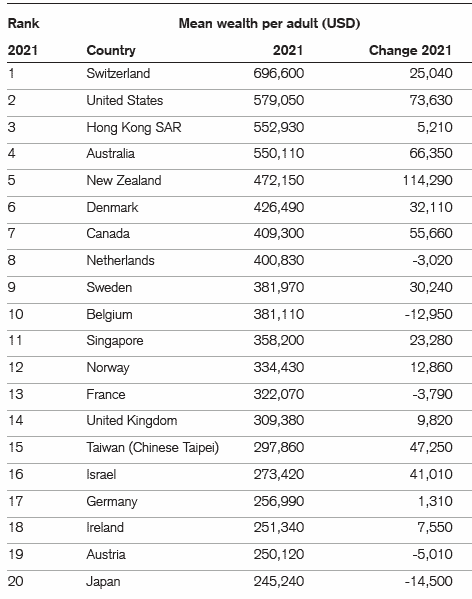

Source: Credit Suisse, Global Wealth Report 2022

Is it true that Australians are the “Richest” people in the world?

What factors that make them become so rich?

Government’s law called ” The Superannuation Gap”

Average income

-

In 2019, net worth worth of an Australian adult is 411 thousand US dollars and the median net worth of people, which calculated from the poorest to the richest, is 191 thousand US dollars. In fact, Australia have never gone down to a recession for 27 years even when there were global financial crisis back in 2008. Moreover, after the widespread pandemic, Covid-19, the median net worth of an Australian adult increased by US$28,450 to reach more than US$273,000 in 2021. This put Australia at the fourth place in the world ranking after Switzerland, the United States and Hong Kong by considering the average income per person.

Geograhical location

-

Australia is one of the country that surrounded by natural resources such as iron, coal, natural gas, and others. This could be benefit to country in a way that they can enjoy exporting those raw materials to other nations across the world, ex. Japan, South Korea, China. In 2018, the net export of Australia went up to 270 billion dollars. However, the employment rate of mining industry is only 3% of Australia’s total workforce.

Housing

-

According to a New Report, Australia is in the top ten country that is the best country to live in. Because of having better quality of live, education, transportation, more and more people want settle down there. The government impose the policy in order to help people to easily get the visa for studying and working. This policy attracts a wealthy and skilled itself to come. In the end, their country earn a lot of money because those people are spending and investing domestically.

The Superannuation Gap

It is a law that mandated working people to contribute a certian percentage of their incomes to a retirement savings account.

-

This law is obligated by the government, meaning that australians have vary few exceptions to aviod. However, it seems like they are mostly happy since those who are doing this program will get a change of tax free in every year. The contribution amount is a mandatory 9.5 %, but in the future it will intend to increase to 15% as the population earn more.

Note: This article is a part of the class 751309 Macroeconomic 2, supervised by Asst. Prof. Napon Hongsakulvasu, Faculty of Economics, Chiang Mai University

This article was written by Kawisara Kongla, 651615002